3D Printing Holds Potential for White Goods

Additive manufacturing is slowly catching on in the appliance industry

With additive manufacturing, multicomponent appliance parts that previously required assembly can now be printed as a single object. Photo courtesy GE Appliances

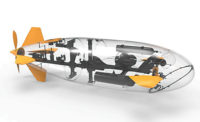

This fully functional air conditioner was produced with additive manufacturing technology. Photo courtesy Haier Group

Whirlpool Corp. is using additive manufacturing to streamline the production of tooling and molds used to produce refrigerator doors. Photo courtesy Oak Ridge National Laboratory

Additive manufacturing has already transformed the way that products are designed and produced in a wide variety of industries. The technology is now starting to be used by appliance engineers to assemble coffee makers, ovens, refrigerators and other household products.

Additive manufacturing “prints” solid objects from a digital file by depositing one layer of material on top of another, rather than starting with a solid piece of material that is cut and shaped. It allows companies to more easily manufacture complex shapes and structures that have traditionally been difficult to make with subtractive manufacturing methods. There’s also less waste, which results in shorter setup times and lower material costs.

Plastic parts are typically made using ultraviolet, infrared or visible light in conjunction with laser or heat energy. Metal parts are produced with laser-based or electron beam-based printers that use metal powders for raw material; the laser or electron beam fuses the powder together.

With additive manufacturing, multicomponent appliance parts that previously required assembly can now be printed as a single object. Engineers can consolidate multiple components or assemblies into one part, eliminating time and assembly costs.

“Traditionally, manufacturing choices [in the appliance industry] are often either injection molding or blow molding,” says David Woodlock, market development manager for 3D printing at HP Inc. “Injection molding can be fully featured, but often requires several parts to be assembled together. Blow molding can create enclosed spaces like tubes and containers, but have to remain largely featureless.

“Additive manufacturing removes these manufacturing restraints, letting you create fewer, smaller and better performing components,” claims Woodlock.

Slow Acceptance

Large appliance manufacturers, such as Electrolux, General Electric and Whirlpool, have been using additive manufacturing to prototype parts, create tooling and produce replacement parts. However, 3D printing technology has been slower to catch on than in other industries.

While full-size automobiles and airplanes have been created with additive manufacturing, no one has yet printed a dishwasher or a refrigerator. But, that’s slowly starting to change.

Engineers at Haier Group, the leading household appliance company in China, recently printed a fully functional window air conditioner. They also used fused deposition modeling technology to create a miniature washing machine that was displayed at a trade show. Parts such as the drum, lid and bezel were printed.

While it is technically feasible to print many types of appliance parts, most experts say it just isn’t economically viable today.

“It’s ultimately a matter of margins,” explains Woodlock. “In the medical industry, for instance, the margin for healthcare devices is extremely high because most of the cost comes upfront in the form of R&D and getting FDA approval. For that reason, it’s easy to justify an increase in direct material cost to create devices that perform better.

“In the commercial aircraft sector, removing a pound of material from a plane will save thousands of dollars a year in fuel costs,” says Woodlock. “So again, an increase in part cost is easily justifiable if it helps you create more lightweight parts. This sort of thing is far less common in the appliance industry.

“Those industries also operate at much lower production volumes, and with higher customization, than with most home appliances,” Woodlock points out. “Today, plastic injection molding is still more cost efficient at high volume, so there’s been less of an opportunity for appliance manufacturers to replace existing parts with 3D printing, even if they perform better.”

“But, as we continue to aggressively drive down the cost per part for additive manufacturing, higher volume applications become more and more accessible,” claims Woodlock. “With that comes greater access to high-volume consumer markets like home appliances.”

Until that happens, additive manufacturing will not be used to create production-ready appliance parts.

“There isn’t always an advantage to printing,” says Nick Okruch, an engineer who manages the Rapid Prototyping Center at GE Appliances. “Most of the time, traditional manufacturing is still the best alternative.

“Where there are advantages [to printing], it usually comes down to one or two things: speed or unique capability,” notes Okruch. “If you can get to production quicker by printing parts while the mold is being built, you will have sped up your time to market and given yourself an advantage.

“The real winner, however, is when you can accomplish something with a printed part that you couldn’t do with a molded part,” adds Okruch. “This may be a feature, appearance or a functional component that is too costly to produce any other way.”

According to Okruch, taking advantage of the unique capabilities of additive manufacturing requires a total mindset change for engineers. “It also requires that a quality manufacturing process be in place to sustain the design into and through its product lifecycle,” he points out.

“Those things are just now coming into practicality in the appliance space,” says Okruch. “We’re looking for the right applications to take advantage of it.”

Traditionally, additive manufacturing has appealed to manufacturers that produce highly complex, low-volume parts. That’s why the technology has become so popular in industries such as aerospace and medical devices, where cost is often not a critical issue.

“Appliances have some interesting challenges that mostly have to do with volume and cost targets,” says Brian Post, Ph.D., a member of the Manufacturing Systems Research Group at Oak Ridge National Laboratory (ORNL) who specializes in large-scale additive manufacturing applications. “Most appliance parts are high-volume and not too complex, with low price margins.

“Printing an entire appliance would be expensive,” says Post, who helped create the world’s first 3D-printed car four years ago. “Additive manufacturing typically makes more sense for use on low-volume products that feature lots of customization. High-end appliances could be a candidate.”

“With next-generation machines, prototyping metal parts for appliances has never been more affordable,” says Greg Mark, CEO of Markforged Inc. “In the past, household appliance manufacturers were limited by the exorbitant cost of previous metal printing solutions.

“But, now they can print functional metal prototypes at a fraction of the cost, practically overnight,” claims Mark. “This is the beginning of a major shift in manufacturing operations that we’re going to see play out in the near future.

“There’s a misconception that additive manufacturing is going to somehow replace casting,” says Mark. “The industry is not at a point where it’s replacing casting.

“However, it can frequently be cheaper to print a part than machine it, especially when it has a very complex geometry,” Mark points out. “That’s why we are getting a ton of interest from metal prototyping, which is faster and cheaper than machining a metal part.”

Safety Issues

Any printed parts used for appliance applications must be able to withstand a variety of conditions. Moisture, humidity and temperature variations are just a few factors that engineers must address.

“[Additive manufacturing] introduces variability, which significantly impacts properties and performance based on how the part is printed,” says Darrin Conlon, director of principal engineers in the appliances, HVACR and lighting division of UL LLC, an independent safety science company.

“One of the challenges is determining if a material’s properties will be affected based on the specific process selected to print the part,” explains Conlon. “For example, if a manufacturer selects a UL 94V-O flame-rated material with certain tensile impact properties for the end-use part, will the material maintain these properties after [it’s been] printed?”

According to Conlon, more research still has to be done to gather data about the effects of 3D printing on ignition, flammability, electrical and thermal distortion material properties. For instance, the mechanical properties of 3D-printed materials have repeatedly been demonstrated to significantly vary based on how test specimens are printed. To address those issues, UL engineers are studying the effects of 3D printing on polymeric materials.

Fit and finish issues are another reason why many appliance manufacturers have been reluctant to invest in additive manufacturing technology. Post-processing adds extra time and expense.

“Household appliances have a very high cosmetic requirement and the customer expectations are for smooth, shiny and easy-to-clean parts,” says Greg Paulsen, director of project engineering at Xometry Inc., a 3D-printing service company that works with manufacturers such as Boeing, Medtronic and Toyota.

“This tends to be a barrier for most thermoplastic 3D printing applications without significant post-processing,” claims Paulsen. “The good news is that technologies and other processing techniques are catching up to demand.”

Finishing printed parts to meet the requirements of consumers is difficult, because many appliance components must be visually and aesthetically appealing.

“[Additive manufacturing applications] in the aerospace and medical industry have centered around small-scale, complex designs,” says UL’s Conlon. “Within the appliance industry, additive manufacturing has seen greater adoption in the area of after-market parts—particularly internal replacement components, such as motor brackets,” notes Conlon.

“Once the technology catches up to the speed of molding parts—and can produce parts more quickly and with a higher-end aesthetic feel—it will be used more widely,” predicts Conlon. “Manufacturers also need to [gain] confidence in the repeatability and reliability of the technology.”

Once that happens, Conlon believes printed parts will become much more common in the appliance industry. “Internal parts are the most likely candidates for 3D printing applications,” he points out. “Some examples include polymeric motor brackets and subassemblies that are contained within the overall product enclosure.”

“For plastic components, fluidic parts, such as ducts, valves and manifolds, are great potential applications,” adds HP’s Woodlock. “For metal, there will be a massive opportunity for heat exchangers, as soon as the cost per part comes down to competitive levels.

“Heat exchanger efficiency is largely tied to creating more surface area,” explains Woodlock. “So, the opportunity for additive manufacturing to create more complex, better performing parts will be nearly impossible for other technologies to match.”

Appliance Applications

Some appliance manufacturers are using additive manufacturing technology to create tooling that’s used for metal stamping and plastic injection molding applications. That can reduce production time, cut costs and help companies get innovative products to market faster.

For the last two years, Whirlpool Corp. has been working on a project with ORNL to print molds that are used to produce refrigerator doors. Engineers developed a new production process that only takes one day vs. the conventional casting process, which can take as long as 14 weeks.

The mold is used to reinforce the plastic liner—the interior part of a refrigerator door that holds shelving—during the injection of insulating foam on the production line. During this process, liquid foam is injected into the refrigerator door between the outer metal case and the inside plastic liner.

The foam expands into every nook and cranny of the door and solidifies. If the liner is not held firmly in place by a mold, it is prone to warping that could prevent a proper fit for shelving.

“This was a nice application for additive manufacturing,” says ORNL’s Post. “The surface finish requirements were not that high, and the mold needed to withstand an environment of only about 100 F and less than 5 psi of pressure. It was a nice jumping-off point for further research.

“We see great opportunities for additive manufacturing in the tooling industry, and for further work in appliance manufacturing where we can make big impacts fast,” explains Post. “For example, the cost of producing custom refrigerators could be reduced by printing appropriate parts or molding.”

GE Appliances is also bullish on the future of additive manufacturing. It has been printing metal and plastic parts for a variety of prototyping

applications. Engineers also use the technology to build tools that streamline traditional manufacturing processes, such as plastic injection molding and thermoforming.

“Approximately 80 percent of what we do is prototyping,” claims Okruch. “However, there are applications where we’re using additive manufacturing for low-volume or short-run production.

"A pizza oven built by FirstBuild, a subsidiary of GE Appliances, has 11 different printed parts created by fused deposition modeling and selective laser sintering," Okruch points out. "We've also used additive manufacturing technology several times to build product service parts or bridge builds until production tooling can be modified or completed.

“With the improvements made in recent years on the speed, cost and quality of printed parts, the cost-effective window (volume and materials) for using [additive manufacturing technology] is opening,” says Okruch. “We need to see if we can take advantage of that in the near term.

“Next will come the leap to designing parts for additive manufacturing,” adds Okruch. “That’s where the real advantages will come. We [will] be looking into that in the near future.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!