Unmanned Cargo Plane to Usher in New Era of Freight Transport

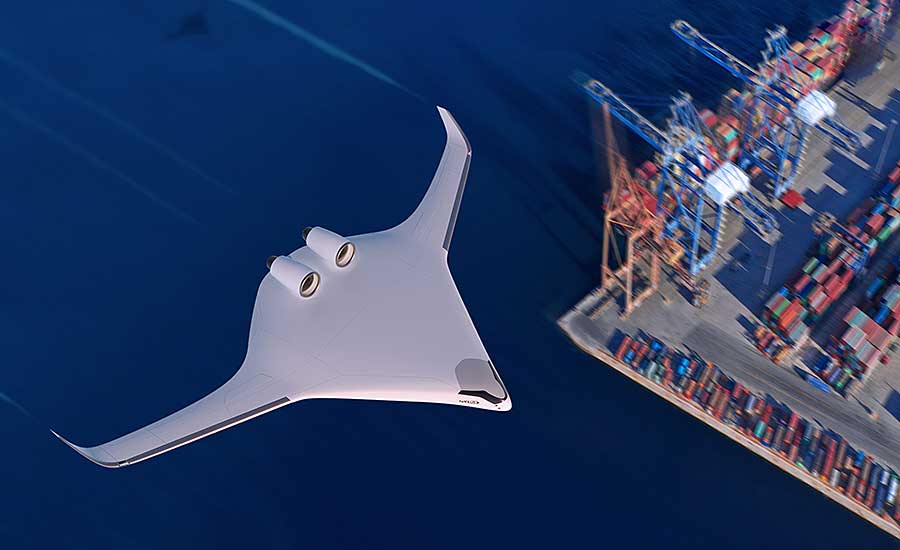

Natilus is developing a family of large unmanned cargo aircraft, starting with this twin turboprop model. Illustration courtesy Natilus Inc.

Blended-wing body aircraft provide more space for cargo and reduce CO2 emissions. Illustration courtesy Natilus Inc.

This next-generation aircraft will use existing ground infrastructure and standard air cargo containers. Illustration courtesy Natilus Inc.

Blended-wing body planes will provide greater efficiency and cost-savings than traditional air freighters. Illustration courtesy Natilus Inc.

Autonomous cargo aircraft will offer an alternative way to ship products overseas. Illustration courtesy Natilus Inc.

This aircraft will be capable of transporting 100-ton payloads over long distances. Illustration courtesy Natilus Inc.

San Diego has one of the richest aerospace heritages of any city in America. Ryan Aeronautical Co. built Charles Lindbergh’s “Spirit of St. Louis” aircraft in the mid-1920s. During World War II, Consolidated Aircraft Corp. mass-produced planes such as the B-24 Liberator and the PBY Catalina.

In the 1950s, Convair’s Atlas Launch Vehicle helped usher in the Space Age. And, as everyone who has watched “Top Gun” knows, North Island Naval Air Station is home to some of the best combat pilots in the world.

A startup company called Natilus Inc. is planning to write the next chapter in San Diego’s illustrious aviation history. It is developing a large unmanned cargo aircraft that may someday revolutionize the air freight and logistics industry.

Natilus plans to design and manufacture a family of aircraft that feature a blended-wing body (BWB) configuration. Unlike traditional tube-and-wing airplanes, BWBs combine the wing, body and tail into a single wing that can generate a 30 percent reduction in fuel consumption.

“The blended-wing design with our patent-pending diamond cargo configuration allows for more volume, helping our customers optimize for the reality of today’s e-commerce freight,” says Aleksey Matyushev, CEO of Natilus. “For the same weight of tube-and-wing aircraft, [our plane] will transport more than twice as much revenue cargo for the same trip, lowering costs by 60 percent and reducing CO2 emissions by 50 percent.”

The planes will use existing ground infrastructure and standard air cargo containers. Natilus recently signed a contract with Collins Aerospace for the design, development and integration of a specialized loading system that will create efficiencies.

Engineers at Collins are creating a unique cargo loading system that features rolling ball mats, attachments and standard flip-up latches. It will accommodate LD3-New and LD3-45 containers and bulk loads.

“Our [suppliers and customers] are excited about the new platform, which will reduce carbon emissions, while increasing cargo volume,” notes Matyushev. “On continents with limited infrastructure, such as Africa and parts of Asia, our aircraft will become an essential mode of rapid and safe transportation.”

The air freight market is currently dominated by aircraft such as the Boeing 747 and 777. According to Matyushev, Natilus’ planes will feature greater efficiency and cost-savings by increasing cargo volume by 60 percent. He claims this will lower the cost of freight operations by 60 percent and cut carbon emissions in half.

“Currently, 90 percent of all goods are transported worldwide via shipping, but 90 percent of all ‘value goods’ are shipped through air freight, because of current capacity and cost,” says Matyushev. “Our goal is to dramatically change this equation through efficiencies of design and operations to make air freight more competitive and capture market share.

Natilus recently announced more than $6 billion in pre-orders for its aircraft. The company is currently building the 3.8T, which features a 90-foot wingspan. The twin turboprop boasts a payload capacity of 3.8 metric tons and a range of 900 nautical miles.

“The design of the 3.8T is complete and has undergone initial wind tunnel testing,” says Matyushev. “[We are] also initiating production of the vertical tails of the aircraft. First flights are scheduled for 2023.

“The biggest challenge is doing the initial engineering work prior to first flight,” claims Matyushev. “[We have] spent more than $2 million in computing hours, with two wind tunnel tests, validating the configuration to make sure there are no problems with the BWB [design].”

In addition to the 3.8T, Natilus eventually plans to produce three other cargo aircraft: the N60T (60-ton payload), N100T (100-ton payload) and N130T (130-ton payload). The latter two models will be equipped with jet engines to enable long-range flights of more than 5,000 nautical miles.

“The main difference between the products is payload and range,” explains Matyushev. “The smaller aircraft are designed around shorter routes carrying less cargo for feeder operations, while the larger models are designed around long-haul routes, which are centered around larger capacities and ranges. [Each model] is designed in payload capacity, engines and range to meet all those missions.

“The aircraft are all similar in components and materials,” Matyushev points out. “Specifically, all the aircraft are made up of carbon-fiber composite airframes, and they share similar autopilot components and similar engine technologies. This will allow us to learn from our smallest aircraft model and apply [lessons learned] to the larger models.”

The entire structure is made out of carbon fiber to help reduce part count on the aircraft. However, aluminum components will be used to reinforce some parts. Matyushev and his colleagues are also considering using additive manufacturing to print wire harnesses.

Aircraft will be assembled in a 12,000-square-foot factory at Brown Field Municipal Airport on the south side of San Diego, near the U.S.-Mexico border. The 104-year-old airfield has been in use since the biplane era.

“Our focus is on aircraft assembly and testing,” says Matyushev. “The runway at Brown Field is 8,000 feet long, which is unique, because most runways are about 5,000 feet. This gives us extra room for testing and allows large aircraft to land at the airport for outsized cargo delivery.

“[Our] facility will use a fully integrated approach to design, build and fly our aircraft,” notes Matyushev. “[Unlike] larger manufacturers that have multiple facilities for each of these tasks, our company was built to be integrated around rapid prototyping and testing, which will allow us to reach the market faster.”

After building a prototype, Natilus will move into the production phase of the program. “We will focus on simplifying assemblies and creating a manufacturing line which is able to produce five to 10 aircraft per month,” says Matyushev. “Unfortunately, due to FAA regulations and lower production volumes compared to the automotive industry, a lot of our factory efforts are still focused on quality and touch labor.

“The largest efficiency gains will come from factory flow layout, and inter-dependency on suppliers for an almost just-in-time manufacturing approach with subassemblies,” claims Matyushev.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!