The need for high-quality medical devices by doctors, patients and medical facilities is great. Because the need is also global, makers of such products are able to contract with the best wire-harness and cable-assembly manufacturers regardless of where they’re located. This reality has helped U.S.-based companies like Advanced Interconnect Manufacturing (AIM) and the Lorom Group find their niche, stay competitive and be successful.

AIMing High in Everything

A little more than four years ago, assemblers at AIM began working on one of the largest and most unique cable assemblies ever made in the company’s 24-year history. The assembly was for a large imaging machine and featured a bundle of 15 cables. Each cable was 0.1285 (8 AWG) to 1 inch in diameter and 85 feet long.

“A big challenge with this assembly was the cables had to have a specific type of insulation,” explains Dave Elliott, operations manager at AIM. “A silicone jacket was used instead of PVC because no insulation damage was allowed at all. The cables were in constant motion, flexing and bending nearly 1,000 cycles per day.”

Each cable contained several separate leads, and all the cables were connected to a PCB or ground point. Custom brackets were included with the cable to quicken installation. Elliott says that AIM has since made several other similar cables for this medical equipment manufacturer.

The origins of AIM go back to 1994 and Rochester, NY, where it began as a spin-off of Eastman Kodak’s wire harness and cable assembly division. This division had supplied harnesses, cables and box-build assemblies for all of Kodak’s lithograph printers and medical equipment since 1960. According to Steve Yost, engineering and sales manager at AIM, the 10 employees who left Kodak to form the new company brought with them more than 100 years of knowledge and experience.

In 2009, AIM was purchased by Cincinnati-based Floturn Inc. and moved to Victor, NY. That same year, AIM became an employee-owned company like its parent, which specializes in metal forming and making photoreceptors for the imaging industry.

Today, AIM has 60 full-time employees, with 45 of them dedicated to building cable assemblies and wire harnesses. John Durst is president.

The company produces 700,000 to 800,000 assemblies and harnesses annually for 150 to 175 manufacturers of medical equipment, transportation vehicles (buses, subway cars, semis), office products, industrial machines, refrigeration units, printers, optical inspection equipment and clean room technology.

According to Elliott, the medical industry accounts for about 60 percent of sales, with transportation garnering another 22 percent. Some manufacturers also refer their Tier 1 suppliers to buy wire harnesses and cable assemblies directly from AIM. One medical-instrumentation company purchases precut and stripped wire in bulk (5,000 pieces at a time) from AIM and then makes its own harnesses.

Elliott says that all company assemblers are trained in-house for a few weeks before becoming IPC-WHMA-A-620C certified. About 30 assemblers work mostly on medical-related harnesses, although all assemblers can work on various types of harnesses.

“Cross-trained assemblers are a big reason for our success,” says Elliott. “During training, we spend a lot of time teaching each worker exactly what to look for during each step of wire preparation. They also learn about checking each wire or cable they’re given to ensure that all previous work steps were done properly. This gives us the confidence to place any assembler in any assembly situation and get a great finished product.”

AIM’s Victor facility encompasses 56,000 square feet, with 40,000 of it dedicated to production. Office space covers 8,000 square feet, and warehousing the other 8,000. Standard hours for production workers are Monday to Friday, 6 a.m. to 2:30 p.m. (with 30 minutes for lunch), although Elliott says the company, since 2015, has tried to schedule enough work so assemblers average five hours of overtime each week.

“Planning on a 45-hour work week provides us with kind of a production cushion,” notes Elliott. “We find it’s more efficient than aiming for the standard 40 hours and then possibly having to lay off and rehire some workers if things slow down.”

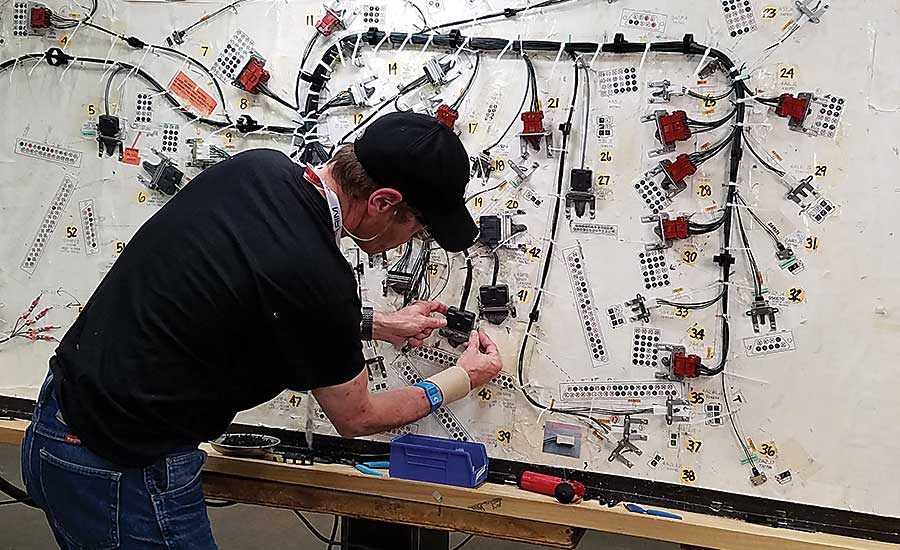

The plant floor has 40-plus workspaces where workers either do manual subassembly work, build and test harnesses on boards made in-house, or operate various wire processing machines. Most wire is cut, stripped, terminated and printed on two fully automated machines from Schleuniger Inc. Workers also use 15 semiautomatic benchtop machines from Schleuniger and Komax Corp.

Assemblers use Random Build from Cablescan Inc. when assembling harnesses. After the worker inserts a wire end, the system indicates the termination point for that wire’s other end on a display panel. A tone indicates that the termination is done correctly. The finished harness is left on the board for continuity and hi-pot testing with a machine made by Cirris Systems.

“We build several layers of quality into each of our assembly processes to overcome the possibility of human error,” claims Yost. “Most of our assemblers have been here 15 to 25 years. In addition, several members of our quality assurance group are former assemblers.”

AIM managers rely on cloud-based Global Shop Solutions ERP software to track the production status of each harness and assembly in real time. Elliott says the software is more user-friendly than its older version.

Many of the OEMs that AIM serves are located in the northeast United States. Several others are in Oregon, Canada and Mexico. One customer each is based in the UK and Germany.

Most of the equipment for which AIM makes harnesses is quite large. For example, a stationary gantry-style X-ray machine that passes over a patient can have a footprint of 40 by 15 feet. The company also makes harnesses for mobile X-ray machines, blood analyzers, medium-size ultrasound machines and computerized tomography scanners.

Looking forward, Elliott and Yost are optimistic about the company’s future while pointing to several ongoing challenges. One is getting harnesses and cable assemblies to customers when they need it—even if that’s weeks before the scheduled due date. Controlling labor costs and meeting growth expectations are also important.

“Harness assemblers benefit from automated equipment, but we need them because the assembly process will never be fully automated,” says Yost. “In terms of growth, we usually aim for 3 to 5 percent annually. Last year’s fourth quarter was strong, and that’s a positive sign for 2018. Because we’re employee owned, each person truly has a stake in the company’s success.”

Nothing, however, is more important than making high-quality products and providing great customer support. These priorities are practiced and understood by everyone at AIM, which has been certified to the UL486a standard (wire connections and soldering lugs fur use with copper conductors) since 1997 and UL508a (industrial control panels and enclosures) since 2012. The plant in Victor became ISO 9000 certified in 2005.

From China, to the World

Long-distance business relationships require hard work to succeed. As COO of the Lorom Group—which has engineering offices in North Carolina, Chicago and California, and 12 assembly plants in India, Taiwan and China—Henning Hansen knows this statement to be true.

“Several staff people here speak Mandarin and have Ph.D.s in their specialty fields, thereby enabling us to build language and culture bridges to workers at our Far East facilities,” explains Hansen. “They also help us build bridges to all of our customers in those regions.”

Hansen joined Lorom in January 2010, some 22 years after Y.T. Yuan founded the company in Taiwan. Yuan was a microwave engineer who had retired at age 42 in the late 1980s from the Taiwanese Navy. He had a great interest in cable assembly, and decided to start a harness manufacturing company in his garage in 1988.

“Yuan called the company Lorom, which means happy progress in Taiwanese Mandarin,” notes Hansen. “He sold his cables by day, and he and his wife would build them at night.”

After five years of growth, Lorom caught the attention of electronic-connector-manufacturer AMP Inc., which was looking to expand its business offshore. AMP contracted with Lorom in 1993, and that same year, Lorom opened a moderate-size plant in Shenzhen, China. Over the next 15 years, the contract manufacturer established several more factories in China, opened a small U.S. sales office in Harrisburg, PA, built a new Shenzhen factory encompassing 1.2 million square feet, and formed working partnerships with Sweden-based Ericsson GE Mobile Communications (maker of handsets) and Endicott Interconnect Technologies (maker of printers).

Lorom’s U.S. engineering and sales headquarters moved to Morrisville, NC, in 2010 for better access to engineering graduates of Duke, North Carolina and North Carolina State universities. One year later, Lorom started making high-speed data cables used by Cisco and other large technology companies that specialize in Internet-related services. Lorom opened its first manufacturing plant in India in 2012.

“Today we operate 11 business units that produce about 100 million harnesses and assemblies annually for the auto, audio, data-center, industrial-automation and medical sectors,” says Hansen. “At peak production time, which runs from August to just before Black Friday, we employ more than 20,000 workers worldwide.”

Shenzhen is where Lorom has assembled all of its medical-related harnesses and assemblies since 2003. Hansen says the campus includes eight buildings encompassing 1.2 million square feet. One building, measuring 150,000 square feet, is dedicated to making harnesses and assemblies for medical industry Tier 1s and OEMs. To ensure that assemblers always have the specific wire, cable and connectors they need, all such products are made in-house using automated equipment.

The plant runs two eight-hour shifts daily, with a production volume of 60,000 to 70,000 units per month. It employs 1,000 to 1,200 people, depending on season, and 800 to 1,000 specialize in assembly work. Workers earn stars for each task they have been trained in: stripping, crimping, soldering (manual or hot bar machine), welding (wire conductors to copper pins), heat shrinking, overmolding, testing and quality inspection.

Assemblers with the fewest stars work on several high-volume, low-mix assembly lines and repeatedly perform one or two basic tasks. Several-star assemblers are assigned to the plant’s many workcells, which are designed for low-volume, high-mix work. Each cell assembler performs multiple tasks and earns about 20 percent higher pay.

A select group of assemblers receive advanced training to work in the facility’s FDA-compliant Class 100,000 clean room. The air in this room contains up to 100,000 particles 0.5 micron or larger per cubic foot, or 700 particles 5 microns and larger per cubic foot.

Hansen says that automated wire and cable extrusion and termination take place in the clean room, as well as semiautomated overmolding of connectors. Lorom is one of only a few contract manufacturers in the world with a clean room where all of these processing steps occur.

“Although automation isn’t extensive for assembly, it is current,” notes Hansen. “Assemblers throughout the plant use 52 Komax machines for crimping wire and cable of all sizes, multiple Schleuniger units to strip braids and jackets from coaxial cable, several Sienna laser strippers (made by Spectrum Technologies) and printers that print directly on wire and cable.”

Stripping and crimping equipment built in-house are also used. In addition, workers at the plant’s machine shop make all necessary tooling, fixtures and jigs, the latter designed to both hold the workpiece in place and guide tooling. All software used at the plant, including the ERP system, is written by Lorom software engineers. A total of 80 work throughout the company.

“Our retention rate for employees overall is 88 to 90 percent,” says Hansen. “Assemblers and machine operators move from their small villages and work at Shenzhen an average of three to five years. After the two-week Chinese New Year break in late January every year, most workers return to the plant, but, about 10 percent stay in their villages and take jobs there.”

Overall, about 400 workers at Shenzhen have been with Lorom for 15 years, and another 80 employees have been there for 20 years. The vast majority of assemblers are women and have one to seven years of experience.

Lorom’s medical division accounts for about 7 percent of company sales. In 2017, Lorom produced harnesses and assemblies for 60 customers, including Boston Scientific, Mindray Medical International Ltd., Medtronic and Otometrics.

Finished products are sent from Shenzhen directly to either a customer’s facility or a nearby warehouse for pickup. According to Hansen, shipments are divided between Asia (60 percent), Europe (20) and North America (20). No products are shipped to South America, Russia, Australia or Africa. Sales growth at Shenzhen last year was 18 percent, and the company expects that number to increase to 22 percent this year.

“The medical industry is a conservative one, in that it’s slow to change and embrace new companies,” concludes Hansen. “As a result, our brand awareness in the industry is still relatively low. We’re taking steps to increase awareness, such as participating in U.S. and European trade shows, and hope to overcome this challenge in less than five years.”