Food processing equipment features some of the most sophisticated automation around. But, most machines are assembled manually. That’s because high-mix, low-volume production is the rule rather than the exception.

Food processing machinery comes in all shapes and sizes to meet the widespread demands of companies that produce beverages, bakery items, candy, dairy goods, frozen food, fruit, meat, poultry, seafood, snack food, vegetables and other edibles. Equipment categories include chillers, dryers, feeders, fryers, grinders, homogenizers, mixers, roasters, separators, slicers and ovens.

Most food processing machines have similar automation and motion control needs, such as material conveying and positioning, heating, drying and cooling. They also require cleanliness, gentle handling and precise control of temperatures, pressures, treatment times and other process parameters. In addition, food processing machinery is often seamlessly integrated with high-speed packaging and labeling equipment.

Equipment and systems designed for the food processing industry share many of the same basic components used in discrete manufacturing, including compressors, electric motors, pumps and valves. But, the machines become even more complex once a labyrinth of digital sensors, pipes, transmitters, tanks, tubes and other components are added into the mix.

And, food processing machinery must be capable of withstanding constant cleaning and disinfecting with all sorts of harsh agents, ranging from steam and water to alkaline solution, organic solvents, hypochlorites, iodine compounds and nitric acid.

Above all, food processing equipment must meet strict regulations enforced by government agencies, such as the U.S. Food and Drug Administration (FDA) and the U.S. Department of Agriculture.

“There are two distinguishing features of food processing machinery,” says Dale Robinson, director of business development for consumer and industrial products at EWI. “If the machinery comes in direct contact with the food product, [it] must be fabricated from stainless steel, and be free from cracks and crevices that might retain food particles. In those cases, stainless steel surfaces—particularly corners and joints—must be ground to specific ‘smooth’ surface finishes to prevent the retaining of food.

“The second distinguishing feature of food equipment is very high processing and packaging speeds,” adds Robinson. “This is particularly true of beverage and snack food processing lines.” Snack foods are typically processed and packaged at speeds of more than 100 bags per minute, while beverages are processed at rates of more than 2,000 cans per minute.

Those requirements make food processing equipment challenging to design and assemble. For instance, engineers must always consider ease of cleaning.

“There are standard tubing and connectors designed for quick cleaning and sanitation,” says Robinson. “Those commercial, off-the-shelf-components are not the problem, however. All custom-designed features, structures and assemblies of food processing equipment must be designed for cleanability. The conventional name for this feature is clean-in-place or CIP.”

“The most complex food machines tend to be the ones that have the highest need for clean design and the largest risk for food bacteria growth,” adds Mike Hosch, director of product and strategic development at Dorner Manufacturing Corp., a leading supplier of conveyors used in food processing applications.

“These are machines that serve the dairy, meat, poultry and fish markets,” Hosch points out. “These areas are governed by the highest restrictions in equipment design, along with tighter limitations for the selection of materials and material finishes.”

The food processing industry uses all types of conveyors, including traditional belted conveyors, modular belt conveyors, side flexing chain conveyors and positive-drive homogeneous belt conveyors. “The type of conveyor technology used usually depends on where the [device] is being used in the food production process,” says Hosch.

Big Appetite

As new niche markets emerge and new products are developed to whet consumer appetites, demand for food processing machinery will remain steady. According to the Freedonia Group Inc., global sales of food processing machinery will grow 7 percent per year to reach more than $53 billion by 2016.

The largest trend defining the world food processing equipment market today is similar to many other industries: rapid sales growth in developing regions, particularly Asia.

“Rising personal incomes are driving increased overall demand for processed foods, along with dietary shifts toward more costly, non-staple items and increased meat consumption,” says Matthew Raskind, an industry analyst at the Freedonia Group.

“As a result, producers are seeking to locate their production facilities closer to these rapidly expanding markets in order to cut costs and capitalize on this growth, which is driving sales of machinery in these areas,” adds Raskind. “[The market for food processing machinery in] China, India, Indonesia and Turkey [will grow rapidly] over the next few years.”

Over the past 10 years, sales of machinery for processing meat, poultry and seafood have grown the most rapidly. “Rising incomes in many developing nations are allowing diets to include more consumption of these items, which tend to be expensive relative to other food items,” Raskind explains.

“Technological advancements in cutting, slicing and grinding machinery have also led to increased sales of these units over the past 10 years, as manufacturers replace older machines with newer products that boost their bottom line through either higher throughput or more efficient [processing],” Raskind points out. “For example, several companies have developed [cutters] that, when the item to be processed is irregular in shape, scan the incoming product and adapt the cutting strategy to produce as many correctly sized portions as possible with the least waste.”

On the other hand, Raskind says beverage machinery has lagged behind the rest of the market in sales growth due to the relative technological maturity of these units. “Compared to machinery used in processing other foods, there are fewer opportunities for technological advancements in these machines,” he claims. “As a result, there are fewer opportunities to generate replacement sales based on the availability of a more efficient unit.”

Due to the incredibly broad range of machinery types and specifications demanded by food processing companies, the industry tends to be quite fragmented. “The seven largest companies have a combined market share of between 10 percent and 20 percent, which is a much smaller figure than for the top companies in most other industrial capital equipment markets,” says Raskind. “With thousands of different individual types of food processing machines produced worldwide, only the largest manufacturers can offer anything close to a complete range of products.”

Most companies typically focus on producing machines that perform one specific task for a wide variety of food products, such as slicers or mixers. Or, they offer a complete suite of equipment covering every stage of processing for a specific product, such as beef.

One of the biggest trends affecting the U.S. food processing industry today is the Food Safety Modernization Act (FSMA). The most sweeping reform of U.S. food safety laws in more than 70 years was signed into law by President Barack Obama in January 2011. It aims to ensure the food supply is safe by shifting the focus from responding to contamination to preventing it.

“FSMA affects machinery builders, but it goes deeper than that,” says Joyce Fassl, editor in chief of Food Engineering magazine (a “sister” publication of ASSEMBLY). “Food and beverage manufacturers are now requesting and updating existing machinery that can be easily washed down.

“Most major food companies have been in compliance with FSMA-like standards for years or are upgrading equipment as quickly as they can,” adds Fassl. “It can be very expensive to buy new equipment, but a lot less expensive than ruining the reputation of a major brand if that product had a food safety issue.”

Assembly Trends

Most food processing equipment is not mass-produced. That allows food companies to customize machines to meet specific standards of their facility. For instance, customers often have their own set of food safety design requirements.

“However, this trend has been changing slightly, [with] the need to shorten lead times and [reduce prices],” says Hosch. “Many manufactures have created standard design product with a large list of options that can be [tailored] to each customer’s needs. This process reduces lead time and also provides consistent design for machine expansion and maintenance in the future.”

GEA PHE Systems, a manufacturer of plate heat exchangers used in food and beverage processing, takes a similar approach to flexible assembly at its state-of-the-art plant in York, PA. “Our frames and heat transfer plates are standard,” says Melissa Fryer, food segment sales manager. “However, how they are configured and assembled is different for every application.”

At JBT Food Tech, one of the largest players in the food processing equipment industry, all machines are designed and built to address specific customer needs. “We have base models, but then incorporate the customer’s modifications based on features, such as heat source, space availability, what types of food will be prepared and many other factors,” says Leonard Mueller, director of operations at JBT Food Tech’s Sandusky, OH, plant, which produces equipment for portioning, coating, frying, cooking and freezing applications.

“For example, customers may need the drive motor or operator station on a different side, or have specific control requirements,” Mueller points out. “Some of our customers have specific hygiene requirements and ask us to modify the equipment to meet these needs. We work hand-in-hand with our customers to ensure they get the equipment they need.”

JBT FoodTech is a high-mix, low-volume food equipment manufacturer. “We have a deep product mix, and nearly every product can be customized from a base model,” says Mueller. “We have very few products that [are] built identically. It is common for our customers to request specific modifications for their unique needs.

“Our team of assemblers and engineers work closely with the customer to outline exactly how the machine should be created, to meet the specific needs of a customer and their processing facility,” explains Mueller. “If a door needs to be moved or a variety of other modifications must be made, our engineers are on site to modify drawings before assembly begins.”

Stainless steel is widely used in the food processing equipment industry. “If the machinery contacts the food product directly, then it most certainly is constructed from corrosion-resistant stainless steel,” says EWI’s Robinson. “The most common alloys used are 304SS and 316SS.”

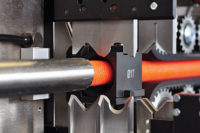

To achieve tight, hygienic seals, welding is the most commonly used assembly method. Engineers rely on a variety of joint designs, including butt joints, corner joints and T-joints. “Less common would be lap joints, as those configurations would likely have crevices and cracks that might trap food particles,” notes Robinson.

According to Mueller, 90 percent of JBT Food Tech’s products are built with stainless steel. Machines are seam-welded and bolted. “Anything that needs to be taken apart for maintenance or used for adjustment is bolted together; otherwise, everything else is welded,” he explains. “Because we modify each piece of equipment based on customer specifications, all of our machines are manually assembled.”

GEA PHE Systems uses high-strength carbon steel, such as SA516 GR 70, to produce its products, which are sealed in cladding. The heat transfer plates are pressed on a 25,000-ton press.

“The automated process gives us quality, consistency and repeatability,” says Fryer. “Die changes are fast and the press bed is one of the largest ones in the world, allowing the three-step pressing process to become one single motion.

“All of our sanitary units’ base and follow plates are CNC machined for a precise fit of cladding and proper gasket alignment of the heat exchanger plates,” adds Fryer. “The final units are manually assembled at 10 welding stations. [TIG welding is used to attach] the cladding to ensure a corrosion-resistant plate assembly.”