Capital Spending Survey: Assembly Plants Boost Spending on Manufacturing Equipment

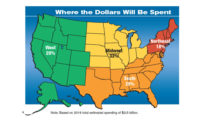

Spending on assembly technology is expected to increase in the West and South, but decrease in the Midwest and Northeast.

In 2013, companies with more than 200 employees accounted for 60 percent of total spending. In 2014, these companies will represent just 39 percent of total spending.

For the first time in the history of our survey, manufacturers of fabricated metal products will spend more on assembly technology than any other industry.

For the first time since 2008, manufacturers of products less than 12 inches long will outspend manufacturers of larger products.

Just 23 percent of plants will buy equipment next year to assemble a new product, an all-time low for our survey.

Due to an above-average response for very small companies, the percentage of respondents with budgets under $250,000 increased significantly.

Only 20 percent of assemblers will spend less on capital equipment next year than they did this year.

Continuing a trend, manufacturers will meet, on average, 40 percent of their assembly technology needs next year with used or rebuilt equipment.

Some 28 percent of assemblers will buy equipment next year to save on material costs. That’s the highest percentage in five years.

Manufacturers are building more of their assembly equipment in-house than ever. Next year, they will meet 48 percent of their assembly technology needs with equipment built internally—a record high.

The good news for U.S. manufacturing continues.

Economic activity in the manufacturing sector expanded in October for the fifth consecutive month, and the overall economy grew for the 53rd consecutive month, according to the latest data from the Institute for Supply Management. The institute’s Purchasing Managers Index (PMI) registered 56.4 percent, an increase of 0.2 percentage point from September’s reading of 56.2 percent.

Of the 18 manufacturing industries covered by the index, 14 reported growth in October, including electrical equipment, appliances, fabricated metal products, transportation equipment, electronics, machinery, and plastic and rubber products.

“The PMI has increased progressively each month since June, with October’s reading reflecting the highest PMI in 2013,” says Bradley J. Holcomb, chairman of the institute’s Manufacturing Business Survey Committee. “The New Orders Index increased slightly in October by 0.1 percentage point to 60.6 percent, while the Production Index decreased by 1.8 percentage points to 60.8 percent. Both the New Orders and Production Indexes have registered above 60 percent for three consecutive months.”

The PMI echoes data collected by the federal government:

U.S. factory output rose 0.3 percent in October, following a 0.1 percent gain in September and a 0.7 percent gain in August, according to the Federal Reserve. Increased output of furniture, metals and electronics shows that gains in manufacturing are extending beyond the auto industry, underscoring reports of improving sentiment at factories. Since October 2012, overall factory output is up 3.3 percent.

Groundbreaking for single-family homes, the largest segment of the market, increased 7 percent in August to a seasonally adjusted annual rate of 628,000 units, according to the Commerce Department. That’s the highest rate since February.

The economy added 204,000 jobs in October, according to the Labor Department. And though U.S. unemployment held steady at 7.3 percent, it’s still at the lowest level since November 2008. For its part, the manufacturing sector gained 19,000 jobs in October, led by companies making motor vehicles and parts, wood products and furniture. So far this year, U.S. manufacturing has gained 35,000 jobs.

Orders for U.S. durable goods rose in September by the most in three months, according to the Commerce Department. Bookings for goods meant to last at least three years increased 3.7 percent, buoyed by strong demand for commercial and military aircraft.

Finally, according to a recent study by the Boston Consulting Group, reshoring is gaining momentum. Due to decreasing domestic energy prices, rising wages overseas and other factors, the United States could regain 2.5 million to 5 million jobs back from overseas by 2020. More than half of executives at manufacturing companies with sales of more than $1 billion plan to return some production to the United States from China or are considering it, according to the report. That’s up from 37 percent in February 2012.

What’s more, the number of respondents in the process of reshoring also rose, with 21 percent currently engaged in returning work to the United States, compared with 10 percent in 2012.

Such reports portend a healthy climate for capital equipment investment next year, and the results of our 18th annual Capital Equipment Spending Survey indicate that manufacturers will boost spending on assembly technology in 2014.

Specifically, U.S. assembly plants will spend $2.94 billion on new equipment in 2014, an increase of 3 percent from the $2.86 billion projected to be spent in 2013.

Some 30 percent of respondents will spend more on assembly technology next year than they did this year, and 50 percent will spend the same as they did in 2013. Only 20 percent of respondents will spend less in 2014 than they did 2013.

Of those facilities that will reduce spending from 2013 to 2014, the average expected decrease is just $98,546.

On average, manufacturers will spend $215,271 on assembly technology in 2014. That compares with $630,360 in 2013, and it’s the lowest average since 2006.

However, it’s important to note that this year’s budget data are skewed heavily in favor of very small facilities at the expense of very large facilities. Indeed, nearly half the respondents to this year’s survey (49 percent) employ 20 or fewer people. In contrast, between 2002 and 2013, only 30 percent of respondents, on average, employed so few people. At the same time, only 8 percent of this year’s respondents employ 101 to 200 people and 11 percent employ more than 200 people. Over the past 12 years, those figures have typically been 18 percent and 21 percent, respectively.

In short, this year’s survey received just half the number of responses from larger facilities than we usually get. When we calculated our projection to reflect the more typical distribution of plant sizes, we arrived at the $2.94 billion total.

Strictly by the numbers, aggregate budget data indicate that 2014 spending will not be much less than it was in 2013. For example, 13 percent of plants will spend more than $250,000 on assembly technology in 2014, compared with 22 percent in 2013. Similarly, 21 percent of plants will spend between $100,000 and $250,000 in 2014 vs. 16 percent in 2013. On the low end, 71 percent of plants will spend less than $100,000 next year, compared with 57 percent in 2013.

So are we playing with the numbers? Will spending increase or decrease? Time will tell. However, there’s no question companies have money to spend. U.S. corporations are currently enjoying the cheapest cost of capital in more than half a century. According to Moody’s, average corporate bond yields are just north of 5 percent. That’s up from 4.5 percent in April, but by historical standards, it’s still dirt cheap. Corporate bond yields haven’t been this consistently low since the mid-1960s.

The difference is that back then, businesses were actually spending that cheap cash, buying equipment, building factories and hiring workers. Today they’re just hoarding it. The pile of corporate cash on the balance sheets of nonfinancial companies has grown to $1.48 trillion, according to Moody’s. That’s an 81 percent increase since 2006.

Despite the abundance of cheap money, however, corporations have so far been reluctant to invest in people, plants and equipment. Averaged over the past two years, U.S. nondefense capital goods orders (excluding aircraft) have increased by just 0.3 percent per month. That’s less than half the rate of business investment between 1993 and 1998, when corporate bond yields averaged around 8 percent and borrowing money wasn’t nearly as cheap as today.

Some of that reluctance might be reflected in how assemblers spent their capital budgets this year. Some 51 percent of plants spent 70 percent or more of their proposed capital budgets for 2013, compared with 55 percent in 2012. At the same time, 24 percent of respondents spent 40 percent or less of their 2013 budgets. That compares with 23 percent in 2012 and 17 percent in 2011.

On average, assemblers spent 60 percent of their 2013 budgets, compared with 63 percent in 2012 and 2011.

Regardless of how much they spend on capital equipment next year, assemblers continue to expect a quick return on investment (ROI). Next year, only 32 percent of plants have an ROI period of at least two years. It’s the fourth straight year in which that percentage has been below 35 percent.

Spending Motives

Replacing old equipment continues to be a priority for ASSEMBLY’s readers. In fact, for only the second time in the history of our survey, it’s the No. 1 reason for investing in assembly technology. Some 45 percent of U.S. assembly plants will be replacing worn-out machinery next year. It’s the third straight year that ratio has been over 40 percent.

Of course, cost reduction remains a top reason for investing in assembly technology, but it may be decreasing in importance. Forty percent of plants will be getting equipment next year to cut costs. That ratio hasn’t been that low since 2011.

If there’s any cause for alarm in this year’s data, it’s this: Just 23 percent of plants will buy equipment next year to assemble a new product. That compares with 29 percent in 2013 and 37 percent in 2012, and it’s an all-time low for our survey.

Other motives for buying equipment include:

increase capacity, 37 percent.

reduce cycle time or eliminate a bottleneck, 23 percent.

implement lean manufacturing, 22 percent.

increase quality, 15 percent.

increase safety, 19 percent.

For the fourth straight year, the top three targets for cost reduction are direct labor (64 percent), indirect labor (34 percent) and scrap (33 percent).

With prices rising for metal, plastic and adhesives, a growing number of assemblers are concerned over the cost of materials. Some 28 percent of assembly plants are looking to lower their material costs next year, the highest percentage since 2010.

The quality revolution of the past two decades appears to have given assemblers a handle on warranty costs. Just 8 percent of plants need to lower their warranty costs next year. That compares with 11 percent in 2011, and it’s a record low for our survey.

One reason for that may be that assemblers have invested heavily in vision systems, sensors and other inspection technologies over the past few years. For example, total machine vision sales in North America rose 6 percent in the second quarter of 2013 compared with the second quarter a year ago, according to the Automated Imaging Association (AIA).

“It’s good to see the market growing again,” says AIA President Jeff Burnstein. “After the contraction in 2012, it is very encouraging to see two consecutive quarters of growth in North America.”

Such investment will likely continue next year. Some 49 percent of plants—a record high—will invest in inspection equipment next year.

On average, assemblers will dedicate 8 percent of their 2014 budgets to vision systems and other inspection technologies. That compares with 7 percent in 2013, and it, too, is a record high. All totaled, assemblers will spend $235.4 million on inspection technology next year, 10 percent more than in 2013.

Just as they have with quality control, assemblers appear to have fully embraced the gospel of lean. Just 13 percent of plants need to lower the cost of work-in-process inventory next year. That compares with 18 percent in 2013, and it’s an all-time low for our survey.

With assemblers less concerned about WIP, there’s evidently less demand for automatic identification technologies. Only 29 percent of plants expect to purchase bar code printers, scanners and other auto ID technologies next year. That compares with 32 percent in 2013, and it’s a record low for this technology category.

On average, assemblers will dedicate just 3 percent of their 2014 budgets to auto ID technologies, a record low. All totaled, assemblers will spend $84.4 million on auto ID technology next year, 38 percent less than in 2013.

New vs. Used

If the Great Recession can be said to have a bright side, it’s this: Lots of quality used equipment is now available at bargain-basement prices, and assemblers are looking for deals.

Next year, manufacturers will meet, on average, 40 percent of their assembly technology needs with used or rebuilt equipment. That ties the percentage in 2013, which was a record high.

The fabricated metal products industry is more likely to purchase used equipment than other industries. Makers of faucets, hinges and other products will meet, on average, 42 percent of their technology needs with used or rebuilt equipment next year. That makes sense. Equipment such as stamping presses, robots and welders are commonly available “previously owned,” and they tend not to be designed to produce a specific product.

In contrast, transportation equipment manufacturers are much less likely to buy used equipment. Assemblers of cars, motorcycles and other products will meet, on average, 33 percent of their technology needs with used or rebuilt equipment next year. That makes sense, too, given the high volumes typical of that industry.

Not surprisingly, small companies are more likely than large ones to purchase used equipment. For example, companies with 20 employees or less will meet, on average, 44 percent of their technology needs with used or rebuilt equipment next year. In contrast, companies with 200 or more employees will meet, on average, 22 percent of their technology needs with used or rebuilt equipment.

The DIY Spirit

More and more engineers are going the do-it-yourself route when equipping their assembly lines. That’s not so surprising, given recent advances in robotics, servomotors, plug-and-play automation components, networking and software. There’s also a plethora of modular structural components available from companies like Bosch Rexroth, Creform, C Tek Industrial, Flex Craft and Item.

In 1998, manufacturers fulfilled, on average, 34 percent of their assembly technology needs with equipment they built in-house. That ratio has been gradually increasing ever since. Next year, in fact, manufacturers will meet, on average, 48 percent of their assembly technology needs with equipment they build internally. That compares with 42 percent in 2013, and it’s a record high for our survey.

This trend holds true for all but the very largest facilities. Over the past four years, companies with 200 or more employees have been below the national average in terms how much of their equipment is built in-house. All other plant sizes have consistently been at or above the national average.

Manufacturers of very large products are more apt to build in-house equipment than those assembling small products. Next year, manufacturers of products larger than a 6-foot cube will meet, on average, 54 percent of their technology needs with equipment they build internally. That compares with 37 percent for assemblers of products smaller than a 12-inch cube.

Compared with other industries, manufacturers of transportation equipment and appliances are less likely to build in-house equipment. Manufacturers in those two industries will meet, on average, 41 percent and 43 percent, respectively, of their technology needs with in-house equipment. In contrast, manufacturers of fabricated metal products are more likely to build equipment in-house. Next year, assemblers of guns, wire baskets and other metal products will meet, on average, 51 percent of their technology needs with equipment they build internally.

What Assemblers Want

For the fifth time in the past seven years, power tools will be the No. 1 item on assemblers’ shopping lists next year. Some 65 percent of assembly plants will purchase impact wrenches, cordless screwdrivers, DC electric nutrunners and other power tools in 2014. That compares with 52 percent in 2013, and it’s the highest percentage since 2010.

On average, assemblers will dedicate 13 percent of their 2014 budgets to electric and pneumatic tools. That compares with 10 percent in 2013, and it’s the largest percentage since 2010. All totaled, assemblers will spend $195 million on tools next year. That’s a 25 percent increase from 2013, and it’s the highest total in five years.

Recent research confirms our analysis. According to market research firm The Freedonia Group, the global market for power tools is expected to increase 4.6 percent annually through 2016 to $28.1 billion.

“Global demand will improve significantly from 2006-2011 market gains, spurred by continued demand in developing regions,” the report notes. “Recovery in the bedrock U.S. market will also benefit demand, bolstered by the rebound in housing construction. In addition, continued industrialization in the developing world will boost demand.”

Cordless electric tools will experience the most robust growth through 2016, advancing 8.3 percent per year. Cordless tools will continue to replace plug-in models, as technological improvements have shortened the power advantage that corded tools once held.

2014 promises to be a banner year for suppliers of welding, brazing and soldering equipment. Some 47 percent of plants will invest in MIG welders, soldering robots and other equipment next year. That compares with 33 percent in 2013, and it’s the highest percentage since 2008.

On average, assemblers will dedicate 10 percent of their 2014 budgets to welding, brazing and soldering equipment, up from 7 percent in 2013. All totaled, assemblers will spend $294.3 million on welding, brazing and soldering equipment next year, 34 percent more than in 2013.

Assemblers continue to invest in robots. According to the Robotics Industries Association, robot shipments to North American customers through September totaled 17,645 units valued at $1.1 billion, breaking the previous nine-month record set in 2012 by 14 percent in units and 9 percent in dollars.

Such investment will likely continue next year. Thirteen percent of plants will buy SCARAs, grippers, tool changers and other robotic technologies in 2014, up from 11 percent this year. All totaled, assemblers will spend $103 million on robots next year, 18 percent more than in 2013 and the most in three years.

The reshoring trend may be producing an uptick in sales for systems integrators. Some 19 percent of plants will invest in multistation automated assembly systems next year, up from 15 percent in 2013. Our study predicts that total spending on automated assembly systems will increase 19 percent, from $433.1 million in 2013 to $515 million in 2014. That’s the highest total since 2009.

Size Matters

What’s unfortunate about getting a higher-than-normal response rate from very small plants isn’t just that their capital budgets are innately small—it’s that these facilities expect to spend less, too.

Just 22 percent of plants with 20 or fewer employees will spend more on assembly technology next year than they did this year, and 29 percent expect to spend less. That’s exactly the reverse of the percentages for the nation as a whole.

Not only will small plants spend less next year, but they haven’t even spent what they planned to this year. On average, plants with 20 or fewer employees have spent 54 percent of their 2013 budgets. That compares with 73 percent for plants with more than 200 employees and 60 percent for the nation as a whole.

Compared with larger facilities, plants with 20 or fewer employees are less likely to buy equipment to:

Assemble a new product (19 percent vs. 23 percent for all U.S. plants).

Increase capacity (27 percent vs. 37 percent for all U.S. plants).

Reduce cycle time (16 percent vs. 23 percent for all U.S. plants).

Implement lean manufacturing (9 percent vs. 22 percent for all U.S. plants).

On the other hand, they are more likely to be replacing old or worn-out equipment (53 percent vs. 45 percent for all U.S. plants).

On average, plants with 20 or fewer employees will spend $28,330 on assembly technology next year. As a group, they will spend some $353.2 million next year, accounting for 12 percent of total spending.

The picture is just the opposite with the nation’s largest assembly plants. Some 31 percent of plants with more than 200 employees plan to spend more next year, while a mere 4 percent expect to spend less.

Compared with smaller facilities, plants with more than 200 employees are more likely to buy equipment to:

Assemble a new product (29 percent vs. 23 percent for all U.S. plants).

Increase safety (28 percent vs. 19 percent for all U.S. plants).

Reduce cycle time (30 percent vs. 23 percent for all U.S. plants).

Implement lean manufacturing (32 percent vs. 22 percent for all U.S. plants).

Conversely, they are less likely to be replacing old or worn-out equipment (26 percent vs. 45 percent for all U.S. plants).

On average, plants with more than 200 employees will spend $1.13 million on assembly technology next year. Together, they will spend more than $1.1 billion next year—39 percent of total spending.

Transportation Equipment

The past year has been one of the best ever for the U.S. automotive industry. Despite having fewer assembly plants than it had in 1999, when U.S. auto production reached an all-time fourth-quarter high of 4.28 million units, the industry is expected to make 4.02 million light vehicles in the fourth quarter of 2013, according to WardsAuto. That would be the best fourth quarter in 14 years, and the fourth best ever.

U.S. auto production is expected to reach 15.6 million units in 2013, and WardsAuto predicts the industry will produce 16.5 million vehicles in 2014 and more than 17 million the following year.

In just the past few months, there has been a flurry of investment activity in the industry:

Automotive supplier Toyota Boshoku is adding 180 jobs at its assembly plant in Mantachie, MS. The company is investing $21 million at the plant, which makes seat components and door panels for the Toyota Corolla.

BorgWarner is investing $24.6 million to expand its assembly plant in Seneca, SC.

As many as 300 new jobs and $100 million in investment will be coming to the Ford Stamping Plant in Hamburg, NY, to support expanded production across the border in Ontario, Canada.

Inergy Automotive Systems opened a new $110 million assembly plant in New Boston, MI, to make plastic fuel tanks. It is expected to create 400 new jobs.

What’s more, the good times in the transportation equipment sector (NAIC 336) extend well beyond the automotive industry:

In November, Boeing broke ground on a second assembly plant in North Charleston, SC. The facility will make jet engine air inlets and could one day be expanded to make a variety of propulsion components.

Daimler Trucks North America is expanding its headquarters in Portland, OR, after state and city officials offered nearly $20 million in incentives.

Nippon Sharyo’s passenger railcar assembly plant in Rochelle, IL, will undergo a $54 million expansion, creating 80 new jobs.

Thus, it’s not surprising that 30 percent of assembly plants in this industry expect to spend more next year than they did this year, and just 14 percent will spend less.

All totaled, transportation equipment manufacturers will spend $353.2 million on assembly technology in 2014, accounting for 10 percent of total spending.

This industry continues to introduce new products. Twenty-eight percent of the plants in NAIC 336 are buying equipment next year to assemble a new product. That compares with 23 percent for all industries, and it marks the eighth consecutive year that this percentage has been above the national figure.

“Lean” continues to be a mantra in this industry. Some 32 percent of plants in NAIC 336 are getting equipment next year to implement lean manufacturing. That’s the highest percentage of any industry, marking the third straight year that the industry has held that distinction.

Safety is another concern among transportation equipment manufacturers. Twenty-two percent of plants are buying equipment to improve safety or ergonomics next year. That’s more than any other industry, and it’s the third straight year that the industry has led the nation in safety-conscious plants.

Compared with other industries, manufacturers of transportation equipment are more concerned about the cost of warranty claims (11 percent vs. 8 percent for all plants), but less concerned about the cost of indirect labor (30 percent vs. 34 percent for all plants) or WIP (6 percent vs. 13 percent for all plants).

As for assembly technology, manufacturers of transportation equipment are more likely to buy dispensing equipment (22 percent vs. 20 percent for all plants), assembly presses (26 percent vs. 22 percent for all plants), conveyors (25 percent vs. 21 percent for all plants), and tooling (62 percent vs. 56 percent for all plants).

Machinery Manufacturing

In November, Caterpillar Inc. opened a sprawling new assembly plant in Athens, GA, that will make small-track bulldozers and mini hydraulic excavators. The plant is expected to turn out 20 tractors and 60 excavators per day. So far, approximately 300 of a promised 1,400 workers have been hired.

Some 500 miles north, in Fairfield, OH, Western States Machine Co. opened a new $6.5 million, 76,000-square-foot factory to make centrifuges. And 600 miles west, Pro-Dig LLC, which makes industrial drilling equipment, announced that it was closing its manufacturing operation in China and building a $5 million assembly plant in Elwood, KS.

Machinery manufacturers (NAIC 333) should continue that sort of investment in the coming year. Some 29 percent of plants in this industry expect to spend more next year than they did this year, and only 11 percent will spend less.

Assemblers of lawn tractors, printing presses, photocopiers, pizza ovens, elevators and turbines will account for 17 percent of total spending next year. In terms of dollars, the industry will spend $500.3 million on assembly technology in 2014.

One reason for the added investment is that the industry needs to add capacity. Half the industry’s plants are investing in equipment to increase capacity next year. That compares with 37 percent for all U.S. plants, and it’s the fourth straight year that NAIC 333 has exceeded the percentage for the nation as a whole.

Another reason is that companies need to get product out the door faster. Thirty percent of plants in this industry are buying equipment next year to reduce cycle time. That’s the most of any industry.

Machinery is not an industry where you can expect to see a steady stream of new products. Only 12 percent of plants will buy equipment next year to make a new product, the lowest ratio of any industry. In fact, for 15 of the past 18 years, the amount of plants in this industry buying equipment to make new products has been below the percentage for the United States as a whole.

Compared with other industries, manufacturers in NAIC 333 are more concerned about the cost of indirect labor (48 percent vs. 34 percent for all plants) and WIP (16 percent vs. 13 percent for all plants). They’re less concerned about direct labor costs (58 percent vs. 64 percent for all plants) and warranty costs (4 percent vs. 8 percent for all plants).

Compared with other industries, manufacturers in NAIC 333 are more likely to buy robots (16 percent vs. 13 percent for all plants); power tools (70 percent vs. 65 percent for all plants); welding, brazing and soldering equipment (61 percent vs. 47 percent for all plants); and test equipment (54 percent vs. 42 percent for all plants).

Computers and Electronics

In August, television manufacturer Element Electronics Corp. said it would invest $7.5 million to build a second U.S. assembly plant in Winnsboro, SC, creating 500 jobs.

In September, Motorola opened an assembly plant in Fort Worth, TX, to make its new smartphone—the first such device ever assembled in the United States. The facility will create 2,500 jobs.

One month later, Raytheon announced plans to expand its radar manufacturing facility in Forest, MS, as it anticipates growth in the airborne radar and electronic warfare markets. The defense contractor will add 20,000 square feet of space and increase its workforce by 150 employees.

Unfortunately, such bright spots are few and far between in the computer and electronics manufacturing industry (NAIC 334). One third of electronics assemblers expect to spend less on assembly technology next year than they did this year. That’s the highest percentage of any industry.

The industry may simply have too much capacity. Only 30 percent of plants will invest in equipment next year to boost capacity, the lowest percentage of any industry. It’s the second straight year the industry has held that distinction, and it marks the eighth time in the past 10 years that the industry has been below the national norm.

Of course, it’s difficult to make plans for investment when sales are down. According to the IPC, total North American PCB shipments decreased 0.7 percent in September 2013 from September 2012. For the first nine months of 2013, shipments are down 3.5 percent while bookings are down 0.6 percent.

The book-to-bill ratio—calculated by dividing the value of orders booked over the past three months by the value of sales billed during the same period—fell below parity to 0.98. A ratio of more than 1 suggests that current demand is ahead of supply, which is a positive indicator for sales growth over the next three to six months. A ratio of less than 1 indicates the reverse.

“Although year-on-year shipment growth in the North American PCB industry is still negative, it has been moving in the right direction,” says IPC’s director of market research Sharon Starr. “The recovery we expected to see in late 2013 has been dampened by the industry’s expectation of slower economic growth in the fourth quarter due to the government shutdown.”

Such market conditions are reflected in demand for electronics assembly equipment next year. Just 8 percent of respondents will buy stencil printers, pick-and-place machines, reflow ovens and other electronics assembly gear next year. That compares with 11 percent in 2013, and it’s a record low.

All totaled, U.S. manufacturers will spend $44 million on electronics assembly equipment in 2014, a decrease of 40 percent.

Compared with other industries, manufacturers in NAIC 334 are more concerned about the cost of indirect labor (46 percent vs. 34 percent for all plants) and scrap (43 percent vs. 33 percent for all plants). They’re less concerned about direct labor costs (30 percent vs. 64 percent for all plants).

Aside from electronics assembly equipment, manufacturers in NAIC 334 are more likely to buy dispensing equipment (25 percent vs. 20 percent for all plants), assembly presses (22 percent vs. 29 percent for all plants), robots (19 percent vs. 13 percent for all plants), auto ID equipment (37 percent vs. 29 percent for all plants), and workstations (61 percent vs. 44 percent for all plants).

As a group, assemblers of clocks, disk drives, phones, radar, thermostats, microchips and other electronic devices will spend $441.4 million on assembly technology next year, accounting for 15 percent of total spending.

Fabricated Metal Products

In July, Delta Faucet Co. announced that it would invest $12 million to expand its assembly plant in Greenburg, IN, creating up to 160 new jobs by 2014.

Our survey indicates that such investments should continue in the coming year. As a group, manufacturers of windows, cans, springs, bearings, guns and other products will spend $941.8 million on capital equipment in 2014. The fabricated metal products industry (NAIC 332) will account for 32 percent of total spending, its largest share ever.

One reason for the increase may be aging equipment. Half the plants in NAIC 332 will buy equipment next year to replace old machines, the most of any industry.

On the other hand, the industry is still dealing with some overcapacity. Only 32 percent of plants in NAIC 332 are looking to increase capacity next year. That compares with 37 percent for all U.S. plants, and it’s the fourth straight year that NAIC 332 has fallen below the national norm.

Compared with other industries, manufacturers of fabricated metal products are less concerned about the cost of scrap (26 percent vs. 33 percent for all plants) than they are about direct labor (72 percent vs. 64 percent for all plants) and WIP (20 percent vs. 13 percent for all plants).

Compared with other industries, manufacturers in NAIC 332 are more likely to buy automatic screwdrivers (28 percent vs. 22 percent for all plants); power tools (74 percent vs. 65 percent for all plants); auto ID equipment (42 percent vs. 29 percent for all plants); computers and software (69 percent vs. 60 percent for all plants), and tooling (66 percent vs. 56 percent for all plants).

Electrical Equipment and Appliances

In just the past six months, Electrolux began production at its first U.S. appliance assembly plant, located in Memphis, TN. Prizer Hoods, a manufacturer of kitchen hoods, opened a new assembly plant in Reading, PA. And, GE Appliances opened a new expanded cooking products assembly plant in Lafayette, GA.

Equipment suppliers can expect such investment to continue next year. One-third of manufacturers in the electrical equipment and appliances industry (NAIC 335) expect to spend more next year than they did this year. A mere 5 percent expect to spend less.

Indeed, 2014 should get off to a hot start. Whirlpool Corp. has announced plans to invest $18.8 million in its oven assembly plant in Tulsa, OK, and add some 150 new employees in 2014. And, refrigeration equipment manufacturer Tecumseh Products Co. is planning a multimillion dollar project to expand its assembly plant in Verona, MS, so it can reshore production from Brazil and France. The company plans to hire up to 150 employees over the next five years.

All totaled, assemblers of lamps, refrigerators, mixers and other electrical products will spend $382.6 million on assembly technology next year, accounting for 13 percent of total spending.

New products are the key to growth in this industry, so it’s no surprise that 33 percent of manufacturers in NAIC 335 are buying equipment to assemble something new. That’s the highest percentage of any industry, and it’s the 16th time in 18 years that the industry has been above the national norm for new product development.

Compared with other industries, manufacturers in NAIC 335 are more likely to buy assembly presses (33 percent vs. 22 percent for all plants); automatic riveters (18 percent vs. 10 percent for all plants); power tools (80 percent vs. 65 percent for all plants); welding, brazing and soldering equipment (52 percent vs. 47 percent for all plants); inspection equipment (56 percent vs. 49 percent for all plants); and wire processing machines (22 percent vs. 10 percent for all plants).

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!